Selling the world’s most valuable life insurance policy earlier this year was undoubtedly a major coup for Hong Kong. Paying an astronomical US$250 million to the beneficiary upon the holder’s death, it was issued by HSBC Life to an ultra-high-net-worth individual (UHNW) whose identity understandably has not been disclosed. The cover surpassed the previous Guinness World Record for life insurance, a US$201 million policy to a US billionaire facilitated by advisory firm SG, LLC in 2014.

The 10-year wait to break the world record is relatively short, considering the previous interval spanned almost a quarter of a century – it was back in 1990 that British life insurance agent Peter Rosengard sold a US$100 million policy to a prominent figure in the US entertainment industry.

To the surprise of many industry insiders, this latest record-smashing policy is fully underwritten by HSBC Life. But what is certain is that it represents a huge vote of confidence in Hong Kong’s financial services industry, and particularly the insurance sector.

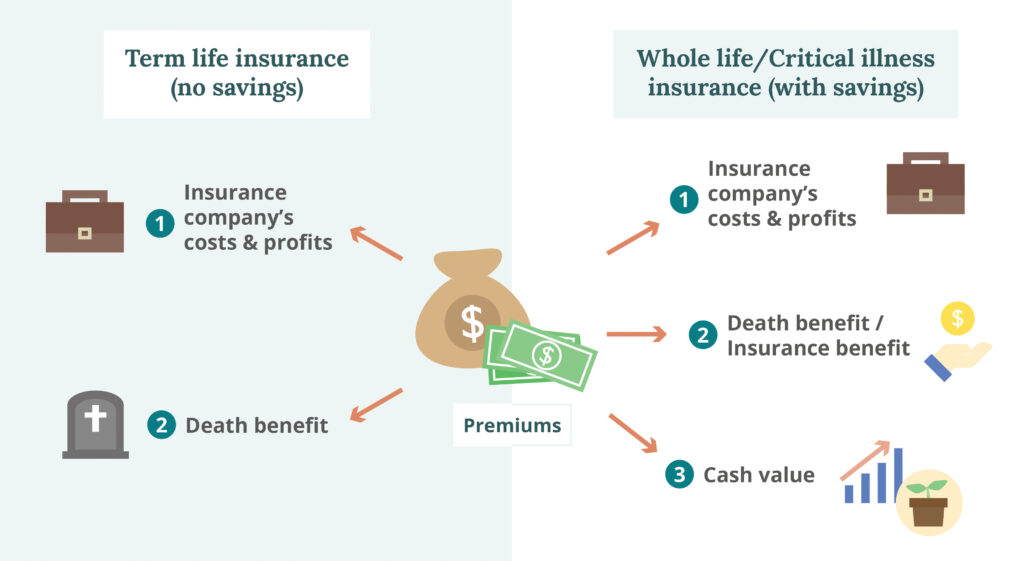

The attention-grabbing sale in question was an HSBC Life Paramount Global Life Insurance Plan, a type of life insurance that offers whole-of-life protection with wealth preservation and legacy planning features. According to HSBC Life, the demand for such policies among UHNW individuals has ballooned over the past year, with a further 10 valued at US$50 million or above issued by the insurance firm to clients seeking facilities for wealth transfer and legacy planning.

High penetration

Hong Kong has been a major player in the world of insurance since the early 20th century, a feat commonly attributed to its relatively stable sociopolitical environment, advanced finance infrastructure, and open-door policy to foreign investment. Given its strong, high-income per capita economy, there is a high life insurance penetration in the territory. Insurance companies eye further expansion via a proliferation of new policies and the city’s rapid growth as an Asian hub, particularly its close ties with mainland China.

“Asia is home to one of the fastest-growing UHNW populations in the world, and as such we are seeing a substantial increase in demand for insurance solutions to address business succession, estate management and legacy planning needs,” says Edward Moncreiffe, CEO of HSBC Life Hong Kong and Macau. He stresses that the issuance of these high-value life insurance policies proves that Hong Kong has reaffirmed its position as both a preferred destination for wealth management and a leading international insurance hub.

“The Hong Kong life insurance market has a number of characteristics that puts us in a strong position to capture this growth in regional UHNW wealth-transfer demand,” he says, citing Hong Kong’s deep talent pools across intermediaries, underwriters and actuaries, strong competition among international banks, brokers and insurers, well-capitalised insurance companies with strong credit ratings, and sound regulatory regime as contributing factors to the thriving insurance services.

Massive sector

According to recent research by GlobalData, a UK-headquartered data analytics and consultancy company, the Hong Kong life insurance market was worth HK$478.2 billion (US$61.1 billion) in 2023 and is expected to grow by more than 3% per annum from 2024 to 2028.

The high level of financial literacy and digitalisation has spawned a diverse range of products in Hong Kong. Major developments have included the growth of finance technology such as insurtech and Environment Social and Governance (ESG) related products, as well as inclusive insurance products aimed at the excluded or underserved market.

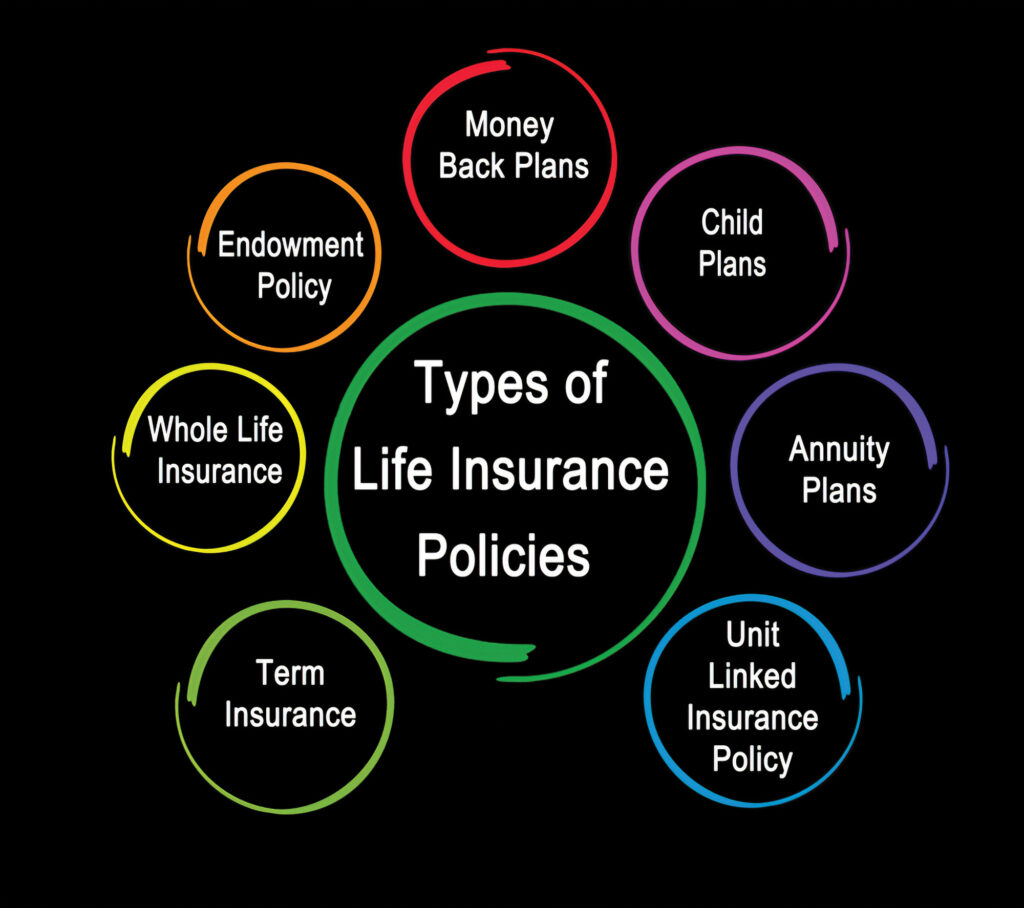

The industry’s leading line of business in Hong Kong last year was whole life insurance. Demand in this area is driven by an ageing society, increased life expectancy and a falling fertility rate. It is also buoyed by inclusivity elements to reflect these societal changes, such as whole-life protection for senior citizens and expanding the package of death and dementia-related benefits.

Mainland surge

Many Hong Kong-based life insurance companies have experienced a surge in interest and sales since the reopening of the border with mainland China in early 2023. Prudential, one of the top three life insurers in Hong Kong, has cited border flow from the north as a major contributor to the vast boost in sales last year. Its annual report stated that mainland customers were looking for “diversification of currency and asset class, professional financial advice across a broad product spectrum, and access to high-quality medical care available in Hong Kong”.

The border reopening came not a moment too soon for Ryan Lam Leong Sing, a Licensed Individual Agent of an insurance company with nearly 15 years of experience. He shares that about 80% of his life insurance business emanates from mainland buyers, adding that sales have rocketed by 30% and the pent-up demand from mainland Chinese eager for Hong Kong life insurance policies is huge. “It’s not difficult – the demand is there,” notes Lam of the influx of mainland buyers, pointing out that they need to be physically present in Hong Kong to sign the policy.

Mainland Chinese are attracted to Hong Kong to buy life insurance policies for a plethora of reasons, including its status as a leading financial centre and its legal system. More specifically, they are limited to US$50,000 per year in currency exchange and transfer out of China “If their money is in Hong Kong, they can exchange whatever they want and transfer it to any country,” says Lam.

Vehicle for growth

Due to Hong Kong’s highly developed financial services sector, life insurance policies here can offer mainland customers a far better vehicle for the growth of financial assets. “The growth of their money is what they are seeking,” affirms Lam. “They maybe want to put it in a trust, and life insurance is an important part in the trust.”

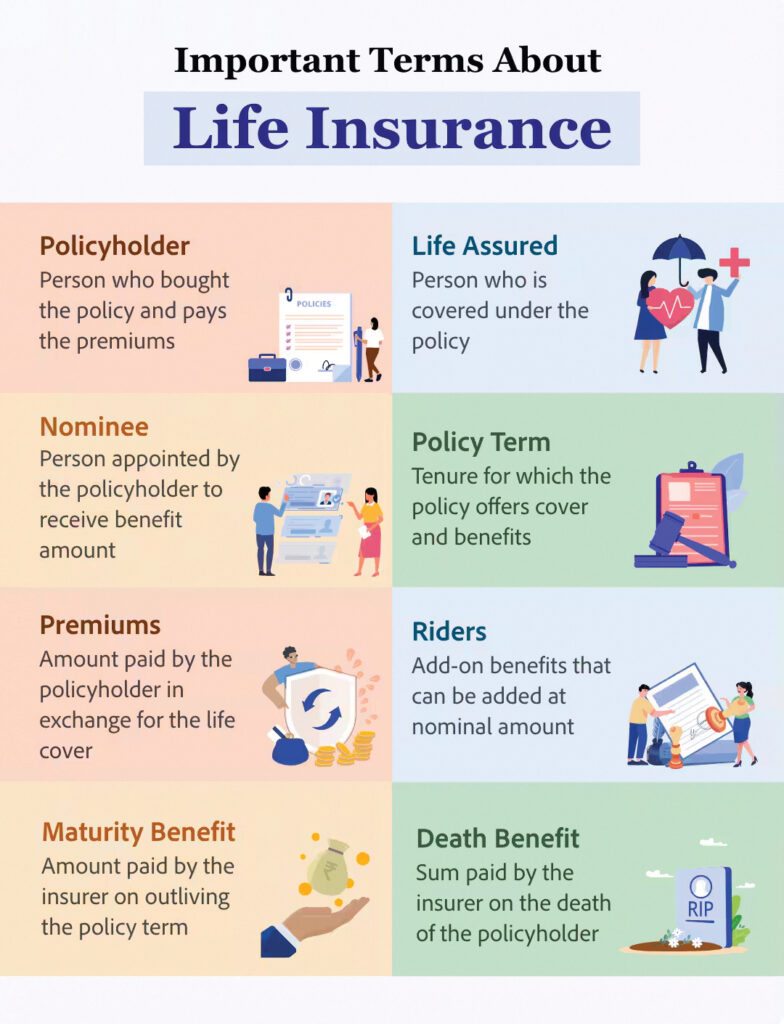

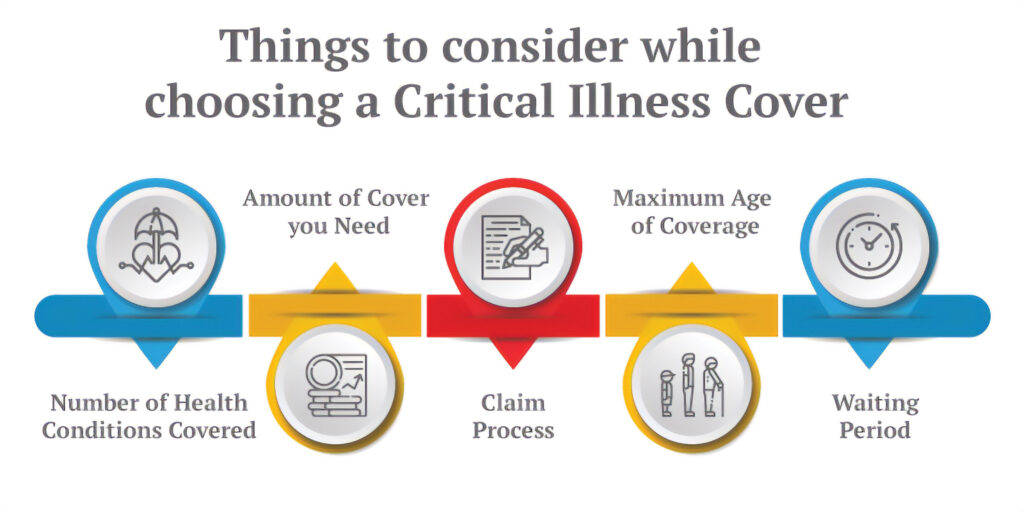

Their life insurance policies fall into three categories: risk management, such as life, accident and medical insurance, and critical illness; savings management, such as savings plans for retirement and educational funds; and investment plans, offering customers a passive income and a fund manager to monitor their money.

Hong Kong attraction

According to Lam, Hong Kong policies have an advantage over those offered on the mainland for paying dividends on the likes of critical illness cover. “In Hong Kong, after 30 years, even if you don’t become ill, you still get money paid out. On the mainland, there is no dividend at all,” he says.

“Then, for some savings plans, like an educational fund or retirement planning, the yearly return is under 3% on the mainland. But in Hong Kong, you can get like a maximum of 6-7%.”

This is important, stresses Lam, as the key component of these types of policies is maximising return for educational or retirement provision, while the insurance part acts purely as the foundation of the plan.

Lam adds that higher operating costs and taxes on the mainland are factors in limiting the level of return there. “Also, in Hong Kong, premiums are reinvested, and they can be put in any market around the world. In China, it is limited to the mainland market.”

The Covid years were difficult for life insurers in Hong Kong as business dropped by as much as 70%. Confidence in the Hong Kong insurance sector hinges on three factors, says Lam – “trust, ability and integrity” – and it appears this is now paying off. While it is not every day that a new policy smashes a world record, the industry has rebounded and sales are soaring.